The revolving door concept in Washington is hardly new. Personnel frequently move between the public and private sectors. However, the Biden Administration has leveraged this trend to its advantage with remarkable cunning, effectively filling a network of purportedly objective student advocacy organizations that provides a smokescreen for the Department of Education’s priorities. While other administrations have come under criticism for such actions, the Biden team has largely evaded scrutiny.

Historically, porous doors between government agencies and the private sector have been thoroughly vetted by media, watchdog organizations, and even Congress. Lobbyists, for example, are required to register and report their activities to ensure transparency and public accountability in government affairs. The Biden Department of Education found a loophole—stack the deck with seemingly objective experts, which it can call on to support its bidding. And this cronyism has reached new levels thanks to deep-pocketed funding and concert coordination.

Biden loyalists’ movement between government and advocacy groups has been concentrated among several organizations, which, as a result, have developed significant influence. This multi-million dollar effort led to the creation of an “Activist Triad” – three new education-focused legal advocacy organizations: 1) The Student Borrowers Protection Center (SBPC); 2) the National Student Legal Defense Network (NSLDN); and 3) the expansion and conversion of Harvard’s Project on Predatory Student Lending (PPSL).

STUDENT BORROWERS PROTECTION CENTER

In 2011, Seth Frotman began working at the newly formed Consumer Financial Products Bureau (CFPB) under President Obama. A former “student loan ombudsman,” Mr. Frotman oversaw the CFPB Office for Students and Young Consumers. In that role, he reviewed complaints from student borrowers about the practices of private lenders, loan servicers and debt collectors. When President Obama left office, Mr. Frotman remained in his position at the CFPB as a holdover under the Trump administration. Mr. Frotman lasted less than a year.

In a scathing resignation letter to acting CFPB Director Mick Mulvaney on August 27, 2018, Mr. Frotman stated that “under your leadership, it has become clear that consumers no longer have a strong” advocate working for them. Director Mulvaney responded publicly that Mr. Frotman overstepped the statutory limits of his position as student loan ombudsman.

Mr. Frotman’s grandstanding resignation had the dual purpose of serving as a job application with progressive activists. In November 2018, he joined fellow former Obama CFPB officials Mike Pierce, Mr. Frotman’s deputy at CFPB, and Bonnie Latrielle, a trusted senior aide from the student ombudsman office, to launch the Student Borrowers Protection Center (SBPC). SBPC received millions of start-up funding from the Arnold Foundation and the Sandler Foundation.

Mr. Pierce still heads the SBPC. Mr. Frotman returned to the CFPB as General Counsel under President Biden. Ms. Latrielle left SBPC to become the student loan ombudsman at the Department of Education.

Since its inception in 2018, SBPC has overtly focused on building state-level opposition to education businesses. The New York Times reported that year, for example, that “in particular, [SPBC] will focus on efforts by state lawmakers and attorneys general to increase their oversight of student loan lenders and servicers.”

Between 2018 and 2020, SBPC continued to welcome a trove of former CFPB employees into its ranks. At least eight former CFPB officials joined SBPC during that period, and the organization adopted and continued to advocate for several CFPB’s policy priorities, all ostensibly centered around student loan forgiveness. Early versions of the SBPC website and much of the information and resources provided on its website and materials were written or produced by CFPB staff.

As part of its state-level mobilization, SBPC targeted State Attorneys General offices under its “States for Student Borrower Protection” campaign, which sought greater oversight of “student loan companies” and a “crack down on their illegal practices.”

In March 2024, SBPC released its findings from a two-year, self-initiated investigation of MOHELA—the start of which followed closely on the heels of the U.S. Supreme Court’s Biden v. Nebraska ruling. Among its complaints, SBPC alleged that MOHELA failed to process student loan forgiveness claims fast enough and that it directed customers to call center representatives instead of an automated system. However, as MOHELA pointed out, it could not process claims—the backlog of which SBPC overstated by as much as 50%—until authorized by the Department of Education, and the call routing was actually done at the behest of the Department of Education’s Financial Student Aid (FSA) office.

SBPC’s “investigation” reveals the organization for what it is: a tough guy ready to do the Department of Education’s dirty work. Unlike the Department, a government agency, SBPC could freely take shots at MOHELA without ramification, effectively operating as the Department’s PR machine—dragging its target through the mud and seeding the ground for likeminded politicians to sound the alarms.

Not surprisingly, after MOHELA responded to SBPC’s allegations, Senator Elizabeth Warren called on Scott Giles, MOHELA’s CEO, to testify before the Senate Banking Committee. Beth Akers of American Enterprise Institute defended MOHELA, saying that Senator Warren used her position of authority to bully MOHELA for “standing up for what they believe is right.”

The Supreme Court’s ruling may also have made MOHELA an appealing target for the SBPC. The Court’s ruling, which recognized MOHELA as a government entity, prevents the organization from being able to sue SBPC for libel—even though, as MOHELA stated, it had no role in Missouri’s lawsuit that challenged President Biden’s student loan forgiven program.

SBPC is financially well resourced. The Arnold Foundation contributed $2.7 million to launch the SBPC and contributed a total of $3.2 million through 2022. Before, the primary financial sponsor was the Resource Legacy Fund (RLF), a Sacramento-based foundation. Since 2022, the organization’s primary funding source has shifted to the Shared Ascent Fund (SAF). The Arnold Foundation took down its grant database from its website, making it more difficult to determine its involvement.

The Resource Legacy Fund has historically been directed toward land conservation, but it also funds left-of-center social policy goals. Between 2019 and 2021, RLF was the largest financial contributor to SBPC. It then spun the organization off to the SAF, which is headquartered at the same address as RLF.

In July 2021, SAF incorporated at SBPC’s address in Washington, DC.35 In short, SAF started serving as the main fundraiser and fiscal sponsor of SBPC, providing administrative, financial, and other support services for a nominal fee. After SBPC and another group was brought under the umbrella of the SAF, its budget increased from $1.7 million to $8.6 million, according to charitable tax filings.

The key takeaway is that SAF is not an apolitical, advocacy organization. Rather, it is yet another progressive organization whose self-proclaimed mission is to “build and execute campaigns to further a broad proactive agenda” and that offers to “manage entire projects or project components for donors.” In other words, its purpose is not to help students but to advance a liberal policy agenda for those with the means to pay for it.

Project on Predatory Student Lending

Established in 2012 at the height of the Occupy Wall Street movement and the nascent formation of the “free college” push, the Project on Predatory Student Lending (PPSL) prides itself on “using bold, strategic litigation and advocacy” to “hold institutions accountable” and “influence policy solutions.” As such, it quickly drew the attention of the Arnold Foundation, which has contributed more than $9 million to the organization since 2016. PPSL did not begin filing lawsuits against education businesses before receiving Arnold Foundation funding.

In 2021, PPSL founder Toby Merrill joined the Biden Department of Education as Deputy General Counsel for Postsecondary Education. Her biography states specifically that PPSL represents borrowers in litigation “against for-profit colleges and against the policies that enable them.” It makes no mention of other types of higher education institutions. It does acknowledge that PPSL “works closely with numerous state and federal enforcement agencies.”

It should raise alarm that one of the Biden Education Department’s top lawyer’s career dedication was to target “the predatory for-profit college industry” and “the policies that enable them” with “strategic litigation.” It is no wonder that Ms. Merrill and the Department of Education have and will continue to ignore the antiquated, woke colleges’ malfeasance and turn a blind eye to public, private, and community colleges.

After the U.S. Supreme Court struck down President Biden’s student loan cancellation program, the Department of Education turned to its “Plan B”: the Sweet v. Cardona lawsuit. The case, which presumes the guilt of more than 150 schools, provided the grounds for the Department to pursue a sue-and-settle campaign. Effectively, the settlement authorizes the Secretary of Education to cancel billions of dollars of loans for students at the named schools—which are disproportionately career colleges— thereby making good on the Administration’s student loan forgiveness promise, at least on some level.

Notably, the lawsuit prevents the colleges that are listed from responding to allegations made by the Department of Education—even though the Department only offers a one-sentence explanation of why the schools are included.

As Jesse Panuccio, a former U.S. Department of Justice official and a legal representative for one of the named school stated last year: “Being publicly branded a presumptive wrongdoer by one’s primary federal regulator, based on undisclosed evidence (or no evidence at all), is a denial of due process and a present and significant injury the appeal states.”

The Department of Education’s presumption of guilt under Sweet v. Cardona has tangible consequences. For example, three intervenor schools documented that they were denied the ability to speak with high school students, lost financing opportunities, and were forced to redirect resources to address questions and concerns from lenders.

At PPSL, Ms. Merrill represented clients in the Sweet v. Cardona lawsuit. A week prior to joining the Department of Education, she dropped the case.

Michael Turi, PPSL staff attorney, and Michael Firestone, a member of the PPSL Board of Directors, both previously worked for Maura Healey, former attorney general of Massachusetts, who has led legal attacks against career colleges since as early as 2016.

“You [PPSL] have been an amazing partner with our office,” Ms. Healey stated in 2022.

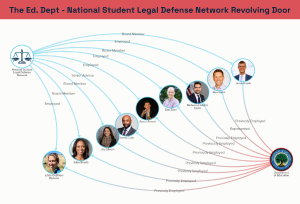

THE NATIONAL STUDENT LEGAL DEFENSE NETWORK

Not as well known as PPSL or SBPC, the National Student Legal Defense Network (Student Defense) is a legal activist organization. It appears to be 90% funded by Arnold Ventures. Student Defense was created in December 2017 by former U.S. Department of Education officials who oppose career colleges and have devoted much of their careers to attempting to destroy the career college industry.

Student Defense has initiated a variety of suits seeking to shield students from paying back what they owe. In Nelson v. Great Lakes, Student Defense sued Great Lakes Higher Education Corporation (Great Lakes), one of seven companies that is tasked with collecting federal student loan debt. The litigation centered around whether the Higher Education Act, the primary federal legislation relating to federal student loans, shields Great Lakes from state consumer protection and debt collection protection laws.

Student Defense vice president Dan Zibel celebrated the result that 44 million student loan borrowers can now object to paying their student loans, not based on miscalculations or illegal interest, but because of subjective disputes of transparency and advertising overstatements.

In 2016, the Obama administration instituted a rule that required the Education Department to discharge student loans when a student’s university or college closed.

In HERA v. DeVos, Student Defense and other leftwing groups sued Trump administration Secretary of Education for deviating from the Obama administration’s automatic discharge rule. The court found that until it is changed through a rulemaking process, the Department of Education is bound to implement the rule.

Among the former Obama officials that are the key drivers of Student Defense:

- Aaron Ament, President and Cofounder: Previously Mr. Ament served as Chief of Staff in the Department of Education’s Office of the General Counsel. Prior to joining the federal government, he served as an Assistant Attorney General in Kentucky. Mr. Ament played a significant role in the targeting of Corinthian Colleges, Inc., and ITT Technical Institute, while at the Department of Education. As Chief of Staff, he helped create the Student Financial Aid Enforcement Office, which has been weaponized against career colleges.

- Dan Zibel, Vice President, Chief Counsel and Cofounder: Prior to joining Student Defense, Mr. Zibel served as Deputy Assistant General Counsel for Postsecondary Education at the Department of Education, where he targeted career colleges. He served as the lead legal counsel to the Enforcement Unit at Federal Student Aid.

- Alex Elson, Vice President for Policy and Cofounder: Before joining Student Defense, Mr. Elson was one of the first attorneys hired by the Department of Education to establish its borrower defense program.

- Libby DeBlasio Webster, Senior Counsel and Co-Director of the PEER Project: Ms. Libby served as a Senior Assistant Attorney General for Consumer Protection at the Colorado Attorney General’s Office. In that role, she litigated many law enforcement actions, including a bench trial against Center for Excellence in Higher Education (CEHE) for allegedly misrepresenting its employment outcomes and affordability of institutional student loans. In addition to her litigation work, Ms. Libby served on the U.S. Department of Education’s negotiated rulemaking committee for the 2014 Gainful Employment Rule. More recently, in addition to her AAG duties, she was the student loan ombudsman for the state of Colorado.

- Alice Yao, Former Senior Counsel: Ms. Yao left Student Defense to join the Department of Education as an attorney in the Office of Civil Rights.

- Mohamed Abdel-Kader, Board of Directors: Mr. Abdel-Kader served as Deputy Assistant Secretary for International and Foreign Language Education in the Department of Education under President Obama.

- Saba Bireda, Board of Directors: Ms. Bireda was a “senior political staff” member of the Obama Department of Education and served as senior counsel in the Department’s Office for Civil Rights. An attorney with “almost twenty years of experience in the education field,” her past clients include NAACP Legal Defense and Educational Fund, Center for American Progress, the Poverty and Race Research Action Council, and EducationCounsel.

- Jacek Pruski, Board of Directors: Mr. Pruski was Associate General Counsel at the Department of Education, where his portfolio included “civil rights litigation, regulatory drafting, oversight, and strategic projects.”

- Joy Silvern, Board of Directors: Ms. Silvern served as the Deputy Chief of Staff at the Department of Education to Secretary Arne Duncan and Secretary John King. Earlier in her career, she worked as a legislative assistant and chief education advisor to Senator Michael Bennet (D-CO).